In its mission to serve the marginalized and uplift Filipino families through its various services, TSPI initiated–and continues to pursue – a bold digital transformation journey driven by a commitment to enhance service delivery and empower both its clients and employees.

The status quo, while effective in the past, would be insufficient to meet the evolving needs of our growing client base. Many of TSPI’s clients, especially in rural areas, faced challenges in accessing timely financial services. The hassles of travelling, hefty expenses, long wait times, and limited communication channels hindered clients from making the most of the opportunities available from TSPI.

Motivated by the desire to serve them better, TSPI launched a comprehensive assessment of its systems and developed a multi-year digital roadmap for digital transformation. With the support of dedicated partners and stakeholders, TSPI began upgrading its systems and rolling out mobile and online platforms that allowed clients to access loan services, monitor repayments, and maximize other features—anytime and anywhere.

In 2000, TSPI took the first step in its commitment to adopt digital solutions by implementing the E-Banker Core System. This laid the groundwork for all future advancements.

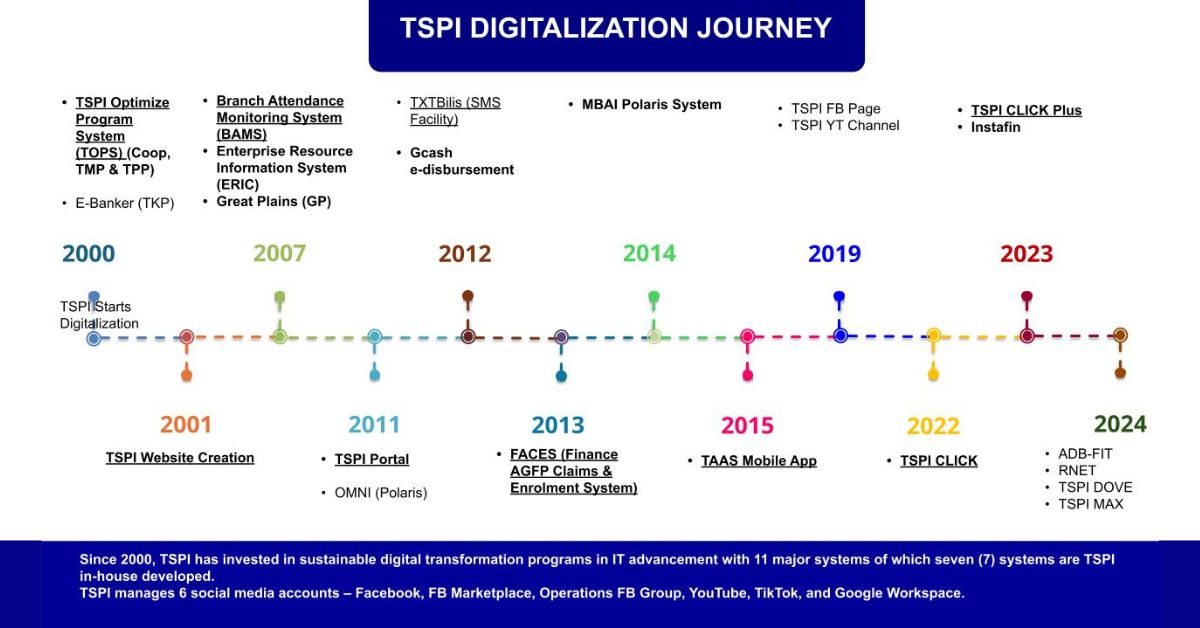

Since 2000, TSPI has invested in sustainable digital transformation programs in Information Technology advancement with 11 major systems, of which seven systems were developed in-house. TSPI In-house systems are: TSPI Optimize Program System [TOPS], Branch Attendance Monitoring Systems [BAMS], TSPI Portal, TXTBilis [SMS Facility System], Finance AGFP Claims and Enrollment System [FACES], now called Treasury AGFP Claims and Enrollment System [TRACES], TSPI Agent Account System [TAAS] Mobile App, and TSPI Check, Loan, Insurance, Capital Build-Up, Kaagad [CLICK]. Almost every 10 years, TSPI implemented digital core systems, namely: E-banker, Polaris, and Instafin.

- 2014 – TSPI developed an in-house micro insurance system for its Mutual Benefit Association (MBAI), called MBA Polaris System, which resulted in proper monitoring of member enrollment by those who avail of micro insurance.

- 2015 – TSPI TAAS mobile application, automating the posting of client’s payment through the accredited agent partners, supervised by TSPI Account Officers.

- 2022 – TSPI launched TSPI CLICK, a comprehensive web and mobile application that provides easy access for clients and staff 24/7 anywhere; purpose is to manage loans, CBUs, and insurance information for accounts and insurance policies to remain current and active, respectively.

- 2023 – TSPI CLICK was upgraded to TSPI CLICK plus, which allows existing clients to apply for loans directly through the platform.

- 2024 – TRACES, an internal reporting system that has been enhanced and fully integrated with the Agricultural Guarantee Fund Pool for the monthly collection of payments from farmers. TSPI employees have access to their own Google Workspace, which has vastly improved internal communications.

As a result of its digital transformation efforts, TSPI was awarded at the 2022 GCash Digital Excellence Awards in pioneering digital finance programs and Digital Champions – MFI Category at the Third Digital Financial Inclusion Awards last December 2024.

As of Dec 31, 2024, TSPI’s digital footprint extended to 119 branches and 116 Sambayanihan centers–all of which make full use of these innovative systems.

All of these endeavors are motivated by TSPI´s care for clients and employees. Without the hassle of spending time and money to personally appear at the TSPI branch, clients are able to make better use of their resources. The CLICK app gives them better access to their accounts.

Digitalization has freed up time spent by employees on tedious paperwork to focus on quality time with their families. The training that they received has also leveled up their skills and expanded career growth opportunities which could be translated into an increase in employee compensation ranging from 30% to 50%.

TSPI is unwaveringly committed to stay ahead of digital transformation to empower more Filipinos with knowledge and aptitude in making full use of technological advancements.

More innovations will be undertaken to modernize systems and to provide better, more efficient service for the benefit of transforming the lives of staff and clients. Moving forward, one of the most-awaited initiatives in digitalization is the upgraded version of TSPI CLICK plus on which the Devotion, Outreach, Values formation and Empowerment (DOVE) transformational tool will be embedded. Clients will have easy access to devotional and inspiring e-materials. It is with great hope as they learn from DOVE, they will be able to put their learnings into practice and eventually empower their communities. TSPI’s Digital Transformation: TSPI’s Digitalization Journey