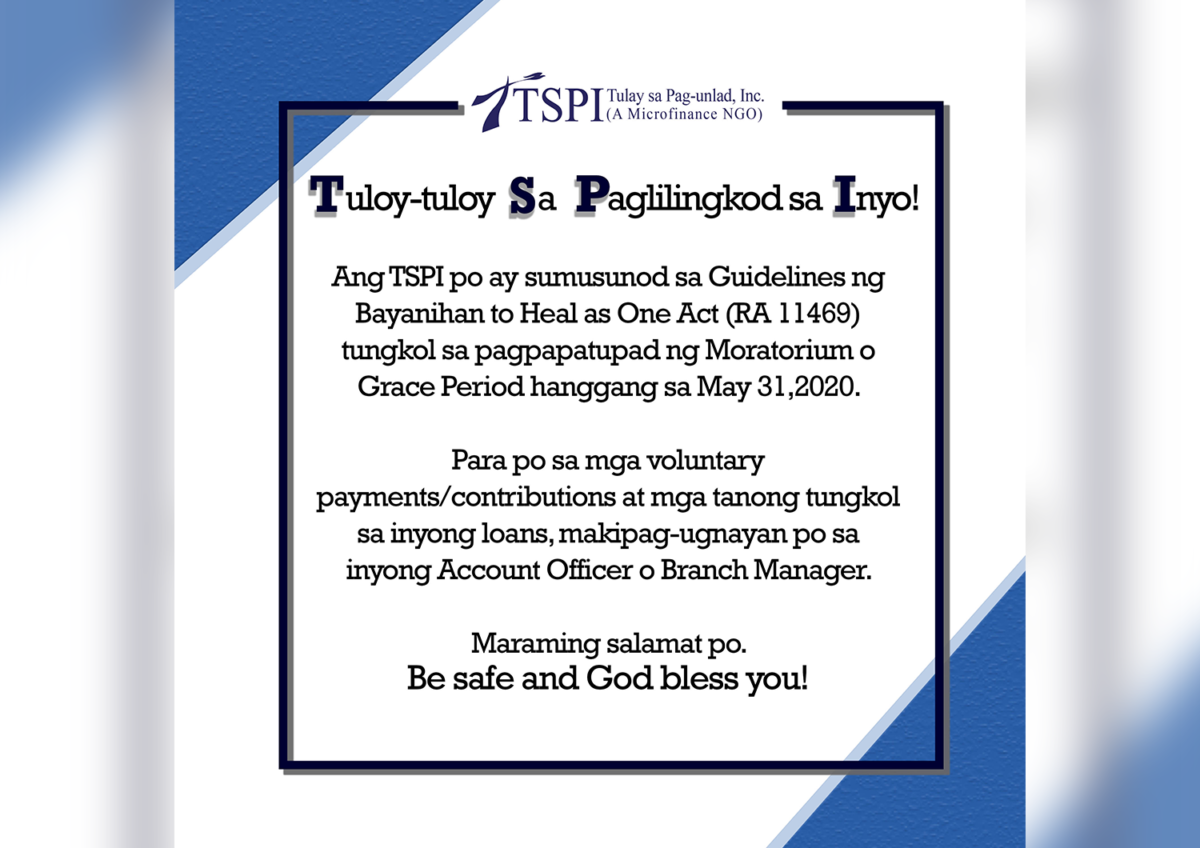

TSPI adhered to the directives of the National Government to provide moratorium on loan payments under the Bayanihan to Heal as One Act (Bayanihan 1) and Bayanihan to Recover as One Act (Bayanihan 2). Financial institutions including microfinance NGOs were mandated to provide clients with a 30-day mandatory grace period either for all loans with principal or for interest within the community quarantine period, or both. Additional 60 days were given to clients who were affected financially by the pandemic.

TSPI implemented a Debt Relief Program providing qualified clients with four options to pay under the Special Loan Payment Option. Clients were assessed based on the status of their business and overall capacity to pay. The ultimate objective is to keep the clients in the program so that they can continue to avail the benefits. To support client’s livelihood, one of the four options allows a top-up amount or an additional to principal balance, with the combined amount to be considered as a new loan.