Lockdown and prolonged community quarantine paved the way for businesses within the community to find a new niche. Sari-sari store owners, fish and vegetable ambulant vendors, direct sellers eventually saw new opportunities and strategies to sustain and grow their livelihood. More so, many of them were also inspired to be of service to the community through their business. To continue helping, TSPI offered new loan programs and further enhanced its processes to align with the needs of the clients, especially under the new normal:

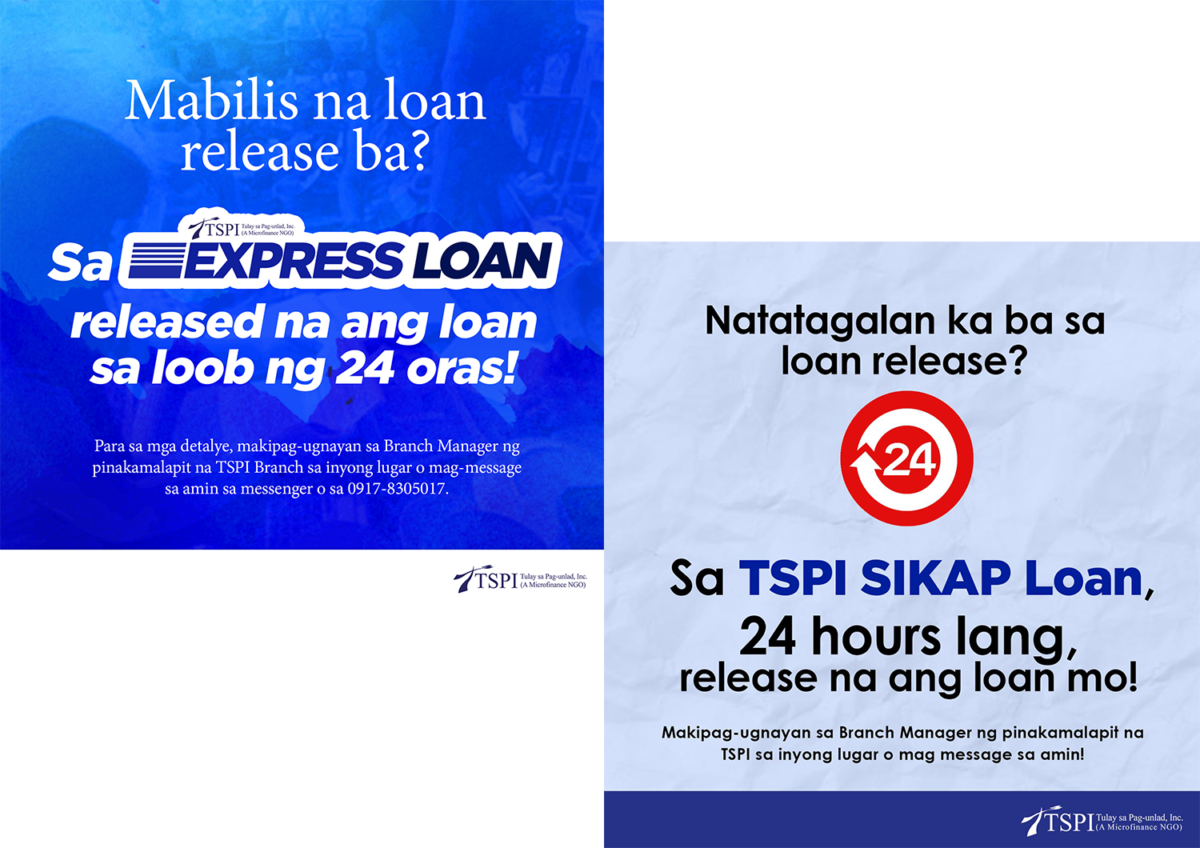

- Sikap Loan Program, August 2020 – The program supported 5,336 clients who needed a smaller loan capital, this translated to a total loan release of Php 26.22 million.

- TSPI Programang Pang-agrikultura – There were 602 farmers with diversified income sources, who availed of the loan. The total loan release was Php 18.78 million at 0% portfolio at risk.

- Credit Line Facility, August 2020 – A total of 1,336 clients qualified for multiple availment under a credit line facility. Total loan release is Php 21.35 million.

- Express Loan, December 2020 – The program benefitted 271 clients through a “same day loan release” scheme with a standard amount of Php 3,000 for Sikap loans and Php 7,000 and Php 10,000 for TKP loans. The total loan release amounted to Php 2.59 million.

- TSPI Agent Account System (TAAS) – Eligible clients/center leaders were certified as TAAS Agents to expand the loan collection facility, especially in the barangays under lockdown. There were 712 TAAS agents with a total collection of Php 918 million from 120 branches.